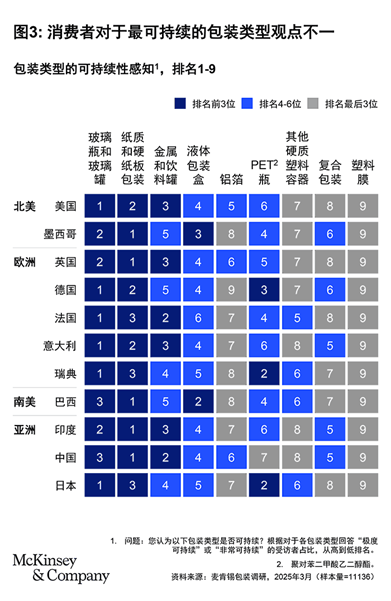

McKinsey's Latest Report Reveals: Sustainable Packaging Must Deliver a "Zero Compromise Experience"; Glass, with Innate Advantages Like Infinite Recyclability, Ranks Firmly in the Top Three for Consumer Sustainability Perception

Amid the global wave of sustainable packaging, rational consumption is becoming the new normal. McKinsey's "2025 Sustainable Packaging Consumer Insights Report," based on a survey of 11,000 consumers across 11 countries, reveals a new trend in sustainable packaging for the post-pandemic era: sustainable packaging must meet consumers' demand for a "zero compromise experience"—delivering environmental value without sacrificing convenience, safety, or affordability.

Glass Ranks Firmly in Top Three for Sustainability Perception, Clear Innate Advantages

Survey data shows that although "food safety," "convenience," and "price" still top the list of consumer decision priorities, glass consistently ranks among the top three packaging materials in terms of sustainability perception across all surveyed countries. This is thanks to three irreplaceable natural advantages of glass:

-

Infinite Recyclability: Glass is 100% recyclable without loss of quality, perfectly aligning with consumers ranking "recyclability" as a key criterion (over 50%) for judging packaging sustainability.

-

Consensus on Safety: Consumers widely agree that glass does not react with contents, making it a safe guarantee for food and beverage packaging.

-

Premium Quality Perception: Glass packaging significantly enhances the perceived value of products, allowing brands to command a price premium.

The "Zero Compromise" Challenge: Three Transformation Pressures Facing the Daily-Use Glass Industry

The report points out that while sustainability is not ignored, it must satisfy the "no-compromise experience." Consumers want to make eco-friendly choices but are unwilling to sacrifice convenience, functionality, or affordability. This consumption trend is progressively moving up the supply chain, posing three major challenges for the daily-use glass industry:

-

Cost Control is a Key Bottleneck: Companies need technological innovation to reduce production costs, preventing green packaging from becoming synonymous with high premiums.

-

Flexible Production Becomes a Core Capability: Increasing product variety and the rise of e-commerce are driving explosive demand for small-batch, multi-variety production. Traditional large-scale, single-product lines can no longer keep up with market changes.

-

Recycling Systems Require Ecosystem Collaboration: Consumer perception of environmental friendliness highly depends on local recycling infrastructure, requiring industry chain collaboration to improve closed-loop systems.

Path to Breakthrough: Three Strategies to Seize the Initiative in Transformation

Based on insights from the McKinsey report, leading daily-use glass companies are gaining market advantage through three strategies:

-

Precisely Focus on Willing-to-Pay Groups: Target groups with strong environmental awareness—young, high-income, highly educated consumers—and leverage their focus on product design and willingness to try new things. Collaborate with brands to develop cleverly designed, differentiated glass products.

-

Intelligent Technology-Driven Cost Restructuring: Utilize flexible glass intelligent production lines to reduce labor, energy, and material costs, achieving a balance between mass production and personalized customization, thus resolving the conflict between cost and diversity.

-

Build Industrial Collaborative Ecosystems: Establish strategic partnerships with upstream glass intelligent equipment manufacturers, downstream brands, and recycling companies. Jointly build glass recycling systems to enhance the sustainability performance of the entire industry chain.

Conclusion: Embracing the Era of Rational Sustainability with Technological Innovation

The McKinsey report highlights an important trend: the changing weight of environmental considerations in consumer decision-making is not a trend reversal but a rational upgrade involving trade-offs. In this context, daily-use glass companies face both challenges and opportunities.

As packaging producers are seen by consumers as the primary responsible entities for driving sustainable development, daily-use glass companies should proactively grasp this trend. By leveraging technological innovation to enhance production efficiency and meet diverse needs, and through industry chain cooperation to improve recycling systems, they can transform the natural environmental advantages of glass into real market competitiveness, gaining an advantage in the era of green consumption trade-offs.

*This article is based on McKinsey's "2025 Sustainable Packaging Consumer Insights Report" and is intended to provide strategic reference for companies in the daily-use glass industry.*